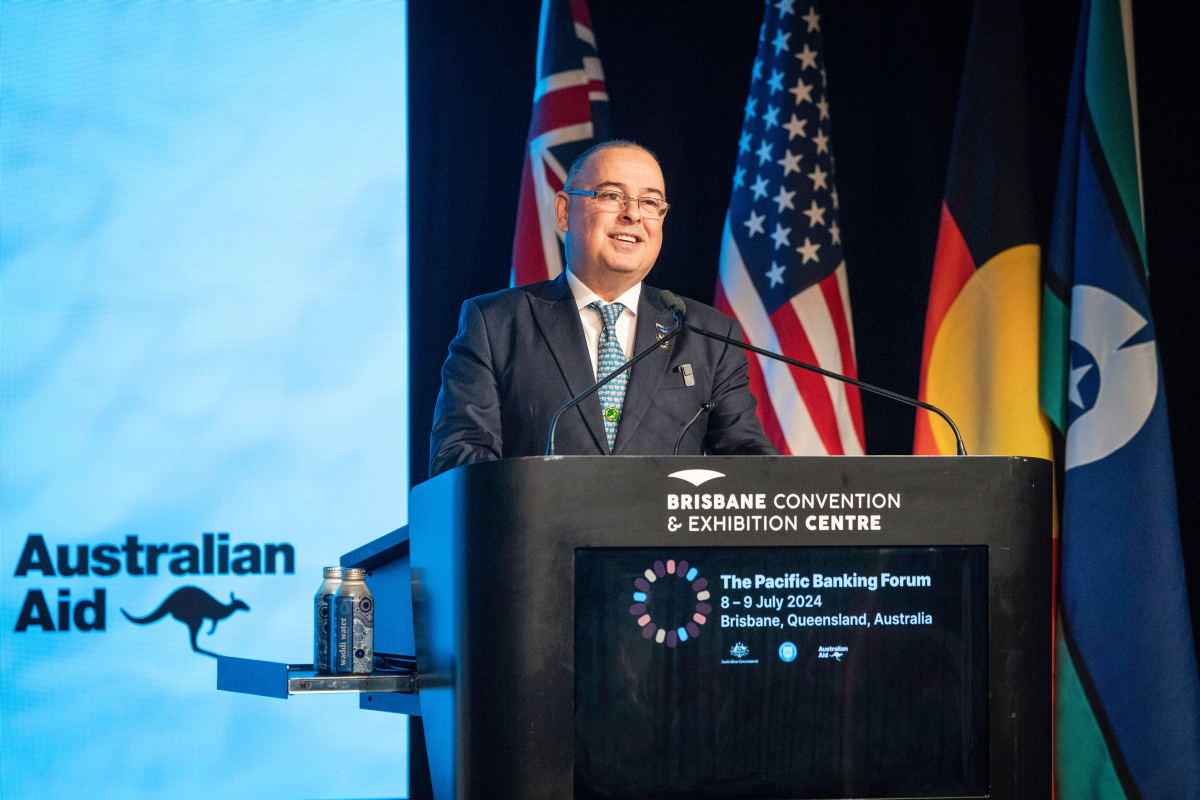

Photo Caption: Cook Islands Prime Minister Mark Brown addresses the Pacific Banking Forum in Brisbane. Photo Courtesy: Pacific Islands News Association

The inaugural Pacific Banking Forum, a landmark event organised by Australia and the United States in partnership with the Pacific Islands Forum in Brisbane this month, has concluded with significant commitments aimed at maintaining the Pacific’s connection to global banking systems. The outcomes from this forum will be presented at the upcoming Forum Economic Ministers Meeting in Suva later in July.

Focus on Regulatory Enhancements and Financial Inclusion

The forum brought together Pacific Heads of State, Treasury Officials, financial stakeholders from Central Banks, global financial institutions, regional and local banks, and international development partners. The gathering focused on ensuring that Pacific people, businesses, and governments regain equitable access to global financial services. High on the agenda were discussions on Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) initiatives.

Cook Islands Prime Minister and Forum Chair, Mark Brown, highlighted the severe impact of the rapid withdrawal of Correspondent Banking Relationships (CBRs) in the region. This withdrawal has significantly hampered local banks and communities from accessing cross-border payment services, thereby inflating the cost of remittances and limiting access to development aid. PM Brown noted that the decline of CBRs is a global issue affecting many developing economies, particularly the Pacific, leading to financial exclusion and restricting participation in global supply chains.

Australia’s Treasurer, Jim Chalmers, reiterated Australia’s commitment to ensuring the Pacific’s access to secure and stable banking. He emphasized that supporting the Pacific in combating money laundering and terrorism financing is a priority for the Australian government. “Ensuring all Pacific countries have access to safe, secure, and stable banking is one of Australia’s highest priorities in the region. You can bank on Australia to work with you to keep the Pacific connected to the global financial system,” Chalmers stated.

Ongoing Projects and Future Steps

Pacific Islands Forum Secretary General, Baron Waqa, discussed a collaborative project between the Pacific Islands Forum and the World Bank aimed at strengthening Correspondent Banking Relationships. This project, born out of the Forum Economic Ministers Meeting in 2023, is currently in the negotiation phase and seeks to ensure continuous access to correspondent banking services across the region.

The focus post-forum will be on enhancing regulatory frameworks, sharing best practices, and tackling emerging financial crime challenges, all aimed at addressing the region’s concerns and improving financial inclusion.

Related article from our archive:

Correspondent Banking decline hampers Island economies, study finds