Papua New Guinea’s National Gold Corporation Bill 2022 is stirring significant concern within the country’s mining sector and the larger economy, as it threatens to establish a gold monopoly that could have disastrous consequences, warns the PNG Chamber of Resources and Energy (CORE).

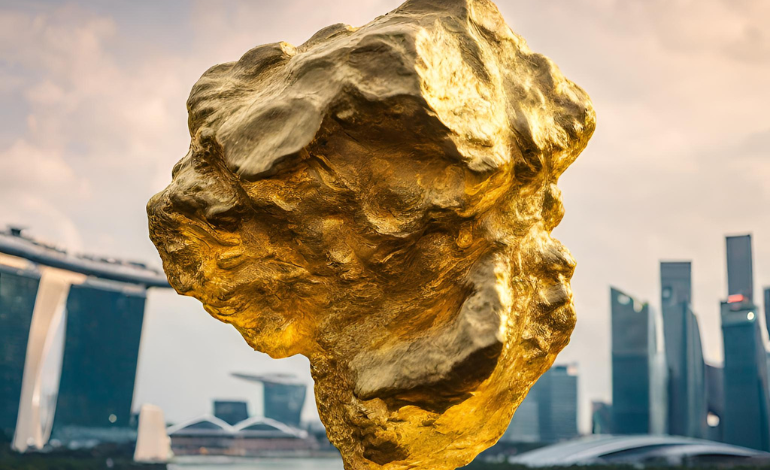

According to the chamber, the bill seeks to create a monopoly by mandating that all gold mined or recovered in PNG must be refined exclusively by the National Mint, a private company majority owned and controlled by a small Singaporean entity, Refinery Holdings Pte Limited. Despite this requirement, the bill permits the National Mint to refine gold anywhere globally while prohibiting any other entity from operating a gold refinery within PNG.

CORE argues that such a monopoly undermines existing marketing arrangements and contracts established by major mines for the sale of their gold internationally, jeopardising their financial sustainability. Additionally, the bill could impact investment confidence in new mining projects promoted by the state, as it restricts alluvial miners from seeking competitive prices for their gold and grants extraordinary powers to a foreign-controlled entity.

Responding to these concerns, Rainbo Paita, Leader of Government Business and Minister for Finance, reassured in the Post Courier newspaper that the government does not intend to relinquish ownership through the proposed bill and suggested that existing mining agreements would remain unaffected. However, CORE remains sceptical, fearing negative implications for investors and financiers crucial for new mining ventures.

CORE further criticises the bill’s provision of extensive powers to the National Gold Corporation, including the creation of subsidiary entities, which could override existing laws and weaken state agencies like the Bank of Papua New Guinea, the Mineral Resources Authority, and the Police. The bill also proposes granting these subsidiaries, controlled by the Singaporean company, authority over Papua New Guinea’s gold reserves and issuance of legal tender, a move deemed as encroaching on the sovereign rights of the state.

CORE contends that the establishment of a gold refinery in Papua New Guinea could be achieved at a fraction of the cost envisioned in the bill, utilizing existing expertise and resources within the country. The organisation emphasises the importance of retaining control over gold reserves and currency issuance within the purview of state institutions like the Bank of PNG, rather than delegating such authority to a private entity.

In essence, the National Gold Corporation Bill 2022 has sparked heated debate, raising questions about its potential impact on Papua New Guinea’s mining industry and economic sovereignty.